What the RBI’s latest data tells us about digital payments in India

And why the easiest interpretation is sus (that's all of my GenZ vocabulary)

The RBI came out with its annual report (for FY 2024-25) last week. It’s a voluminous read and sits at 318 pages long. I won’t lie. I didn’t read it in entirety. Instead, I focused on what I found most interesting – the trends in digital payments.

Particularly, I want to talk about the trends in prepaid payment instruments (PPIs)1, credit cards and debit cards. Since our attention spans are short, I’ll break up this piece into two parts. This is the first, which focuses on PPIs.

What struck me the most about PPIs is that we saw a stark dip in their use. The first in the last few years. And such that it almost forms a downward ‘V’ on the volume of transactions chart below. So, what explains this fall in both the volume and value of PPI transactions?

One perspective is that PPIs are losing relevance in the era of UPI. Here’s what an Economic Times piece says in support of that argument:

Around 403 million mobile wallet payments were recorded in June this year [2024], 24% lower compared with 530 million such transactions a year earlier [2023], data from the Reserve Bank of India show. The number has also been falling sequentially every month since January, when it was more than 576 million.

Throughout this year, these prepaid payment instruments have shown a decline in transactions with January recording more than 57 million wallet payments, compared to the next six months when it kept declining to the 40 million range…

Large fintechs like PhonePe, Google Pay, Paytm and Amazon Pay are all focused on the UPI story currently.

Mobile wallet transactions on slippery slope as UPI rises, Economic Times

Look, the beautiful thing about data is that there are many ways to interpret it. ET believes the steep decline in PPI numbers in 2024 is an ominous sign for PPIs. I believe that’s probably incorrect.

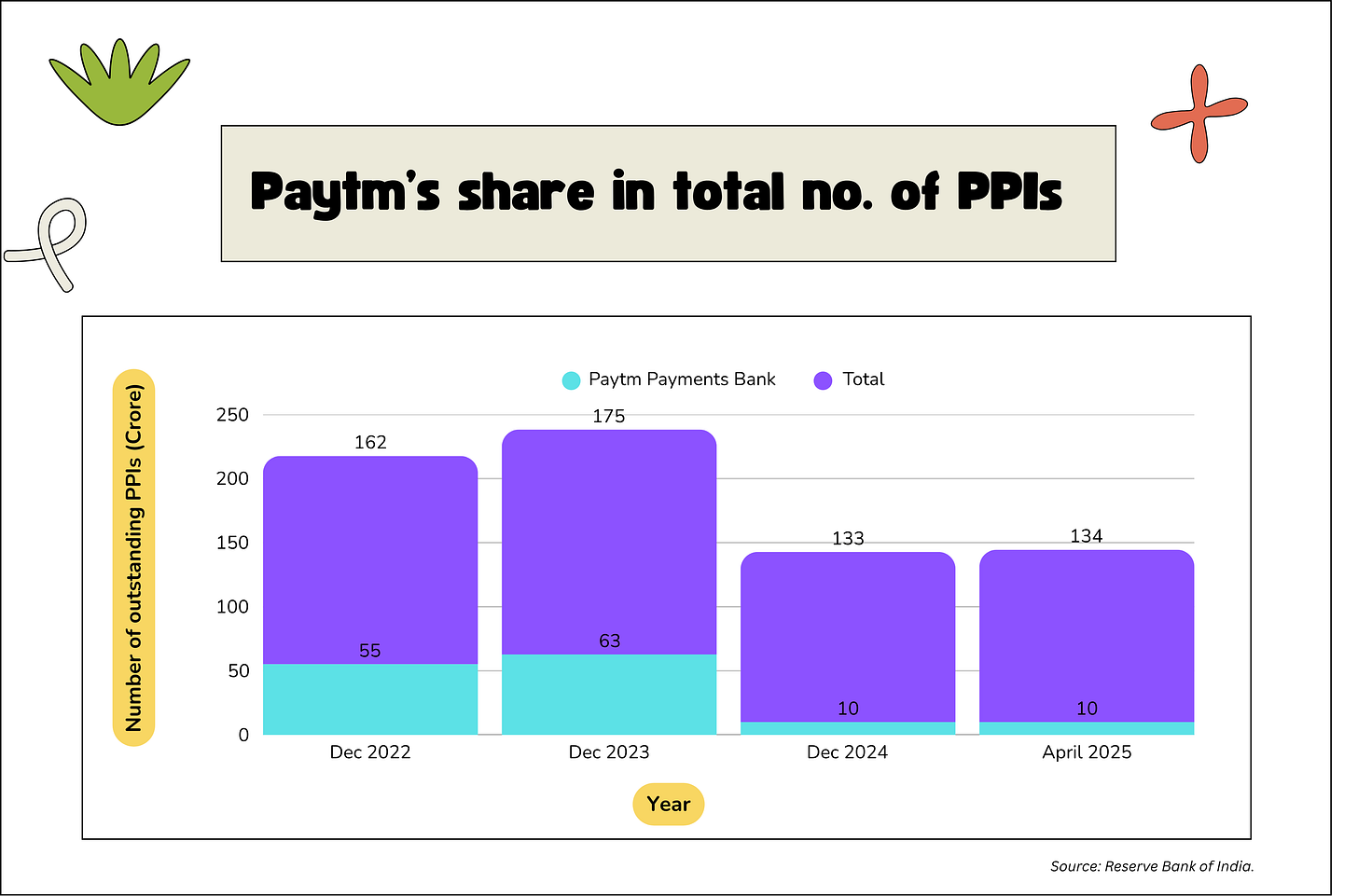

Yes, PPIs have had a tumultuous life since UPI came about. But it’s now been 9 years the launch of UPI. And once the disruptive effects of UPI settled, PPIs found a niche for themselves (think Amazon Pay wallet). Between 2019 to 2024, the volume of PPI transactions grew at a 6.25% CAGR.2 Nothing explosive like UPI, but steady. Same goes for the number of PPI accounts. They touched a high of 175 crores (both cards and wallets)3 in December 20234, before drastically declining to around 134 crores by April 20255. I also find it hard to agree with ET’s view that fintechs are losing interest in PPIs. In fact, 14 new entities6 got licenses to issues PPIs in 2024 (including Jupiter and Cashfree) - the most in last 15 years.

Clearly, 2024 was an outlier year for PPIs. So, what explains the drastic decline then?

Paytm. The RBI took action against Paytm Payments Bank in January 2024. It restricted Paytm from onboarding new customers and prevented them from taking any new deposits from customers from the first quarter of 2024. It also flagged concerns around Paytm’s KYC practices and large number of dormant accounts. And that has made all the difference. In December 2023 (a month before the RBI’s action), 1 out of every 3 PPIs was a Paytm PPI.7 At the end of April, 2025, that number was reduced to 1 out of every 13 (just 7.5%). In absolute terms, Paytm had 62 crore PPIs as of December 2023, and just 10 crore come April, 2025. Where did the remaining 50 crore PPIs go? Paytm probably shut them down because they weren’t KYC compliant, or were dormant. Naturally then, a steep fall in the number of PPI accounts had ripple effects on the transaction value and volumes on PPIs.

Now, you might ask - are PPIs apart from Paytm doing well?

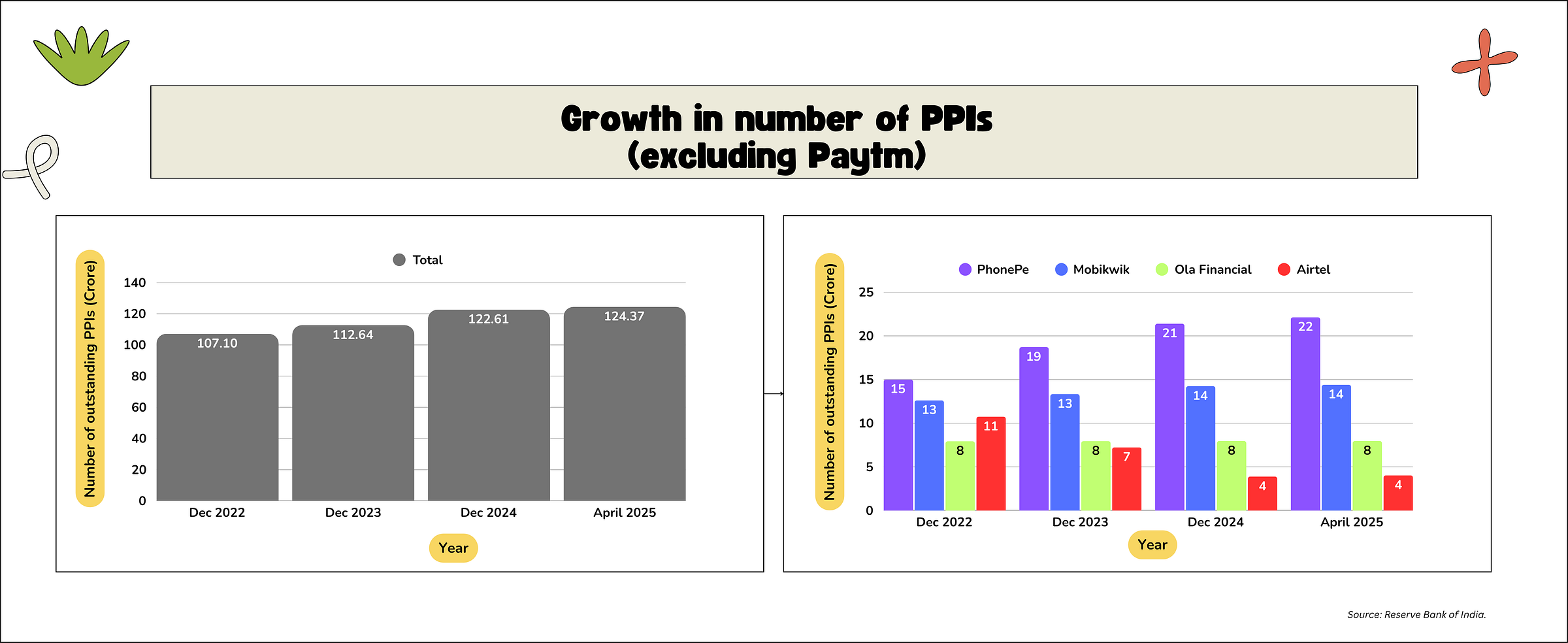

If we exclude the outlier - Paytm, the remaining players have still collectively exhibited growth in the number of active PPIs at around 5-8% year on year. Barring Airtel, all major PPI players exhibit the same trend. PPI accounts at Phonepe have grown at over 10% in each of the past 3 years and it takes the crown for the leading non-bank PPI issuer. Mobikwik and Ola Financial have seen modest growth. What about Airtel? They’ve likely followed Paytm’s suit and closed all dormant PPIs. Given their past regulatory troubles, it seems more like housekeeping than a downward trend.

So, what does the data tell us about PPIs?

Three things. One, 2024 was an outlier year for PPIs. The ripple effects of RBI’s action against Paytm Payments Bank can be seen across all major data points for 2024-25. The decline in value and volumes on PPIs in 2024 can be largely attributed to that one event. Two, If we leave aside Paytm, the PPI numbers for the other players are still growing steadily, even if slow. Phonepe has shown tremendous growth in issuing new PPIs. Three, PPIs are not dying. Instead, fintechs are keener than ever to issue PPIs. Why? You can read about that here.

That’s it for part 1. If you’ve made it this far, thanks for reading and stay tuned for part 2.

If you’ve ever used a Paytm or a Phonepe wallet, you’ve been using a PPI all along. That’s the technical name. PPIs come in two form factors – cards and e-wallets. I’ve used ‘PPI’ to colloquially refer to all form factors of the PPI – cards and wallets.

Page 55, Payment Systems Report, Half Year ended December 2024, Reserve Bank of India.

All my calculations treat each card and each wallet as a unique PPI. I know that there are cases where a PPI card may be linked to a PPI wallet. Ideally, these shouldn’t be treated as 2 unique PPIs for an accurate calculation. But that’s just not possible given how RBI calculates and releases this data.

Entity-wise PPI Statistics, December 2023, Reserve Bank of India.

Entity-wise PPI Statistics, April 2025, Reserve Bank of India.

Page 166, Annual Report 2024-25, Reserve Bank of India.

Entity-wise PPI Statistics, December 2023, Reserve Bank of India.